It is hard to believe that a full year has passed since we divested our portfolio from 70% of fossil fuel producers. This month, we are celebrating this first anniversary, gauging our progress, and looking ahead at next steps in our efforts to respond to the global threat of climate change. Two years ago, we launched Zoos and Aquariums for 350 and introduced fossil fuel divestment to our community. We are thrilled to hear that zoos are reviewing investment policies and selling stock in fossil fuel companies.

The divestment movement is making progress and gaining momentum.

- "The global movement calling on universities, religious institutions, cities, and states to stop investing in the fossil fuel industry is growing faster than any other in history now spanning 697 campaigns worldwide. Stanford University, the Rockefeller Brothers Fund, 34 cities, and the World Council of Churches — representing over half a billion members — are among the 700 investors worth more than $50 billion who have already committed to going fossil-free." -Grist.org

- NRG, a power company in the US, has pledged to cut carbon emissions 90% by 2050. Why? Partly as a direct response to the divestment movement. Their chief executive explains: “If divestment from fossil fuel companies becomes the issue that preoccupies college campuses around America for the next decade, I don’t relish the idea that year after year we’re going to be graduating a couple million kids from college, who are going to be American consumers for the next 60 or 70 years, that come out of college with a distaste or disdain for companies like mine.”

-A recent paper in Nature found that "globally, a third of oil reserves, half of gas reserves and over 80 per cent of current coal reserves should remain unused from 2010 to 2050 in order to meet the target of 2 °C." This reaffirms what we know about "unburnable carbon": if climate change is to be curtailed, fossil fuel companies will not be able to burn their reserves. Fossil fuel investments, which value reserves as assets, become increasingly more risky as more scientists and policy-makers reiterate that reserves must be left in the ground.

Our divested portfolio has gotten better returns than the estimated performance of our previous fossil fuel-heavy portfolio.

One of the key questions and obstacles to jumping on board with divestment is concern about financial impact. We're happy to announce that our 1-year portfolio results are very strong. As of 31 January 2015, the estimated performance of our previous fossil fuel-heavy portfolio was 5.6%, while our current, 70% divested portfolio, returned 6.6%.

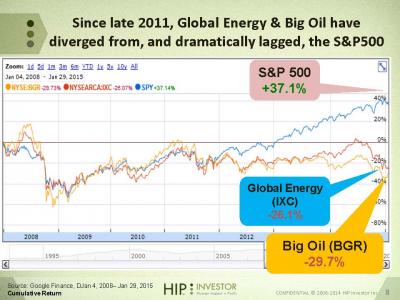

We remain committed to full divestment by the end of 2017. To achieve this goal, HIP Investor, the financial advisers who created our fossil fuel-reduced portfolio, are helping us to identify newly available fossil-free funds. In addition, we are encouraging managers of our current mutual funds to make all their investments free of fossil fuel producers. Doing what’s right for the planet is also right for your portfolio. Standard & Poor's, the world's leading index provider established a Carbon Efficient Index, which measures the investment performance of large cap U.S. companies with relatively lower carbon emissions. This index has out performed the S&P500 every year since its launch in 2009. In addition, since late 2011, the global energy and big oil indexes have diverged from, and dramatically lagged, the S&P500. For more than 3 years, indexes for coal, oil, and gas have underperformed the S&P500 and carbon-efficient investments have performed better than carbon-intensive ones. Those who held fossil fuel producers in their portfolios likely lost more money than if they had divested.

Doing what’s right for the planet is also right for your portfolio. Standard & Poor's, the world's leading index provider established a Carbon Efficient Index, which measures the investment performance of large cap U.S. companies with relatively lower carbon emissions. This index has out performed the S&P500 every year since its launch in 2009. In addition, since late 2011, the global energy and big oil indexes have diverged from, and dramatically lagged, the S&P500. For more than 3 years, indexes for coal, oil, and gas have underperformed the S&P500 and carbon-efficient investments have performed better than carbon-intensive ones. Those who held fossil fuel producers in their portfolios likely lost more money than if they had divested.

Global Divestment Day is being celebrated on 13-14 February. Visit http://gofossilfree.org/ to find activities that might be in your area.